Bankroll Management with Keeks: Dynamic Strategies

In our previous posts, we’ve explored various bankroll management strategies, from the mathematically optimal Kelly Criterion to the capital-preserving CPPI. Today, we’ll examine Dynamic Bankroll Management, an adaptive approach that adjusts bet sizing based on recent performance and market conditions.

What is Dynamic Bankroll Management?

Dynamic Bankroll Management (DBM) is a flexible strategy that modifies your bet sizing based on various factors that change over time, such as:

- Recent performance (winning or losing streaks)

- Volatility in your results

- Changes in your edge or confidence

- Market conditions or opportunities

Unlike static strategies that apply the same formula regardless of circumstances, DBM adapts to the evolving landscape of your betting or investing environment.

The Theory Behind Dynamic Bankroll Management

The core principle of DBM is that optimal bet sizing should respond to changing conditions. While there’s no single formula for DBM, a common approach is to start with a base strategy (like Kelly or Fixed Fraction) and then apply modifiers based on recent performance:

Adjusted bet size = Base bet size * Performance modifier

Where the performance modifier increases during winning streaks and decreases during losing streaks, but within predefined limits to prevent excessive risk-taking or excessive conservatism.

Pros of Dynamic Bankroll Management

- Adaptability: Responds to changing market conditions and performance

- Psychological alignment: Naturally bets more when confident and less when struggling

- Streak exploitation: Can capitalize on winning streaks more effectively

- Drawdown protection: Automatically reduces exposure during losing periods

- Customizable: Can be tailored to your specific betting style and risk tolerance

Cons of Dynamic Bankroll Management

- Complexity: More complex to implement and understand than static strategies

- Parameter sensitivity: Results depend heavily on how you define the dynamic adjustments

- Potential for overreaction: May reduce bet sizes too much after normal variance

- Potential for overconfidence: May increase bet sizes too much during lucky streaks

- Backtesting challenges: More difficult to backtest reliably due to more parameters

Implementing Dynamic Bankroll Management with Keeks

Using Dynamic Bankroll Management with Keeks is straightforward:

from keeks.bankroll import BankRoll

from keeks.binary_strategies.dynamic import DynamicBankrollManagement

from keeks.simulators.repeated_binary import RepeatedBinarySimulator

import matplotlib.pyplot as plt

# Create a bankroll with initial funds

bankroll = BankRoll(initial_funds=1000.0)

# Create a Dynamic Bankroll Management strategy

# Base strategy is Fixed Fraction with 3%

# Increase bet size by up to 50% during winning streaks

# Decrease bet size by up to 50% during losing streaks

# Look back at the last 5 bets to determine streak

dbm = DynamicBankrollManagement(

base_fraction=0.03,

max_increase=0.5, # 50% increase

max_decrease=0.5, # 50% decrease

lookback_period=5

)

# Simulate 1000 bets using Dynamic Bankroll Management

simulator = RepeatedBinarySimulator(

payoff=1.0,

loss=1.0,

probability=0.55,

trials=1000

)

# Run the simulation

simulator.evaluate_strategy(dbm, bankroll)

# Plot the results

plt.figure(figsize=(10, 6))

plt.plot(bankroll.history)

plt.title('Bankroll Growth Using Dynamic Bankroll Management')

plt.xlabel('Number of Bets')

plt.ylabel('Bankroll Size')

plt.grid(True)

plt.show()

# Plot the bet size as a percentage of bankroll over time

plt.figure(figsize=(10, 6))

plt.plot(dbm.bet_fraction_history)

plt.axhline(y=0.03, color='r', linestyle='--', label='Base Fraction (3%)')

plt.title('Dynamic Bet Sizing Over Time')

plt.xlabel('Number of Bets')

plt.ylabel('Bet Size (% of Bankroll)')

plt.legend()

plt.grid(True)

plt.show()

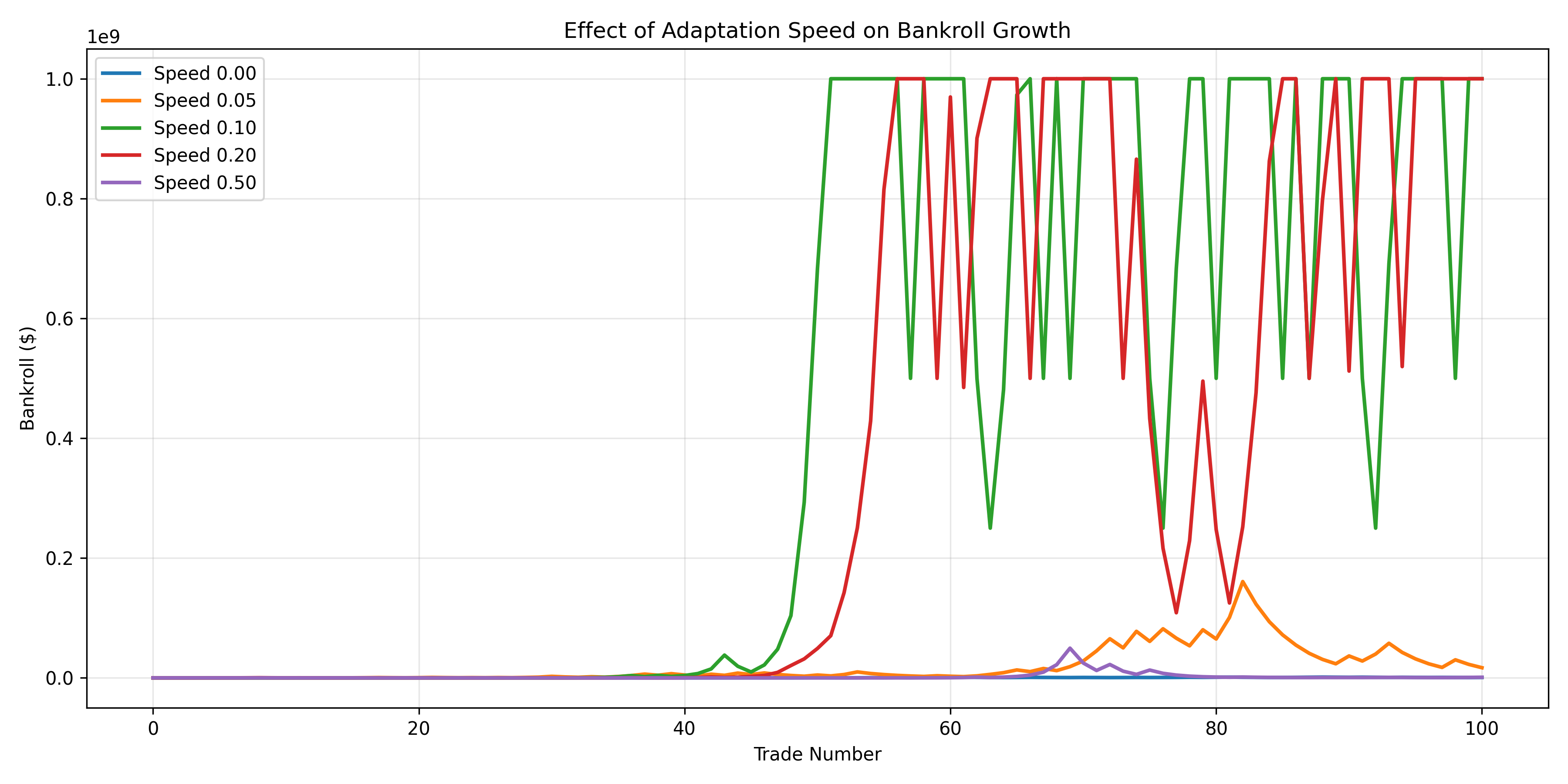

Comparing Different Dynamic Strategies

Let’s compare different configurations of Dynamic Bankroll Management:

import numpy as np

from keeks.bankroll import BankRoll

from keeks.binary_strategies.dynamic import DynamicBankrollManagement

from keeks.simulators.repeated_binary import RepeatedBinarySimulator

import matplotlib.pyplot as plt

# Set up our simulation parameters

win_probability = 0.55

payoff = 1.0

loss = 1.0

trials = 1000

initial_funds = 1000.0

# Create strategies with different dynamic parameters

strategies = {

"Conservative (±25%, 3 lookback)": DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.25, max_decrease=0.25, lookback_period=3

),

"Moderate (±50%, 5 lookback)": DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.5, max_decrease=0.5, lookback_period=5

),

"Aggressive (±75%, 5 lookback)": DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.75, max_decrease=0.75, lookback_period=5

),

"Asymmetric (↑25%, ↓50%, 5 lookback)": DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.25, max_decrease=0.5, lookback_period=5

)

}

# Create a simulator with fixed random seed for fair comparison

simulator = RepeatedBinarySimulator(

payoff=payoff,

loss=loss,

probability=win_probability,

trials=trials,

random_seed=42 # Fixed seed ensures same sequence of wins/losses

)

# Run simulations

results = {}

fraction_histories = {}

for name, strategy in strategies.items():

bankroll = BankRoll(initial_funds=initial_funds)

simulator.evaluate_strategy(strategy, bankroll)

results[name] = {

"history": bankroll.history.copy(),

"drawdowns": bankroll.drawdown_history.copy()

}

fraction_histories[name] = strategy.bet_fraction_history.copy()

# Plot the bankroll histories

plt.figure(figsize=(12, 8))

for name, data in results.items():

plt.plot(data["history"], label=name)

plt.title('Comparison of Dynamic Bankroll Management Strategies')

plt.xlabel('Number of Bets')

plt.ylabel('Bankroll Size')

plt.legend()

plt.grid(True)

plt.show()

# Plot the bet fraction histories

plt.figure(figsize=(12, 8))

for name, history in fraction_histories.items():

plt.plot(history, label=name)

plt.axhline(y=0.03, color='k', linestyle='--', label='Base Fraction (3%)')

plt.title('Dynamic Bet Sizing Comparison')

plt.xlabel('Number of Bets')

plt.ylabel('Bet Size (% of Bankroll)')

plt.legend()

plt.grid(True)

plt.show()

# Calculate and display statistics

for name, data in results.items():

history = data["history"]

drawdowns = data["drawdowns"]

final_value = history[-1]

max_value = max(history)

max_drawdown = max(drawdowns) * 100

growth_rate = (final_value / initial_funds) ** (1 / trials) - 1

print(f"{name}:")

print(f" Final bankroll: ${final_value:.2f}")

print(f" Growth rate: {growth_rate:.2%} per bet")

print(f" Maximum drawdown: {max_drawdown:.2f}%")

print()

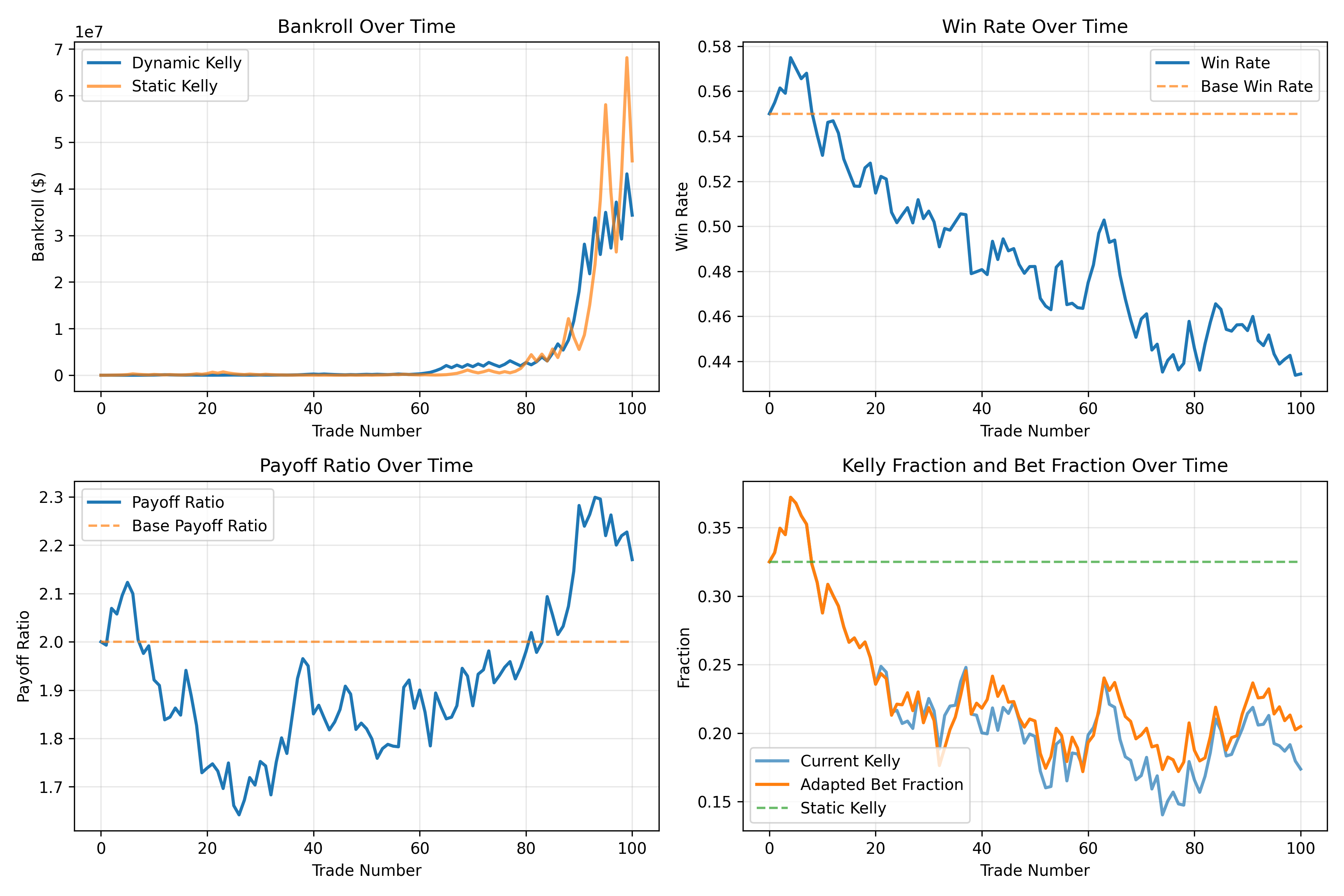

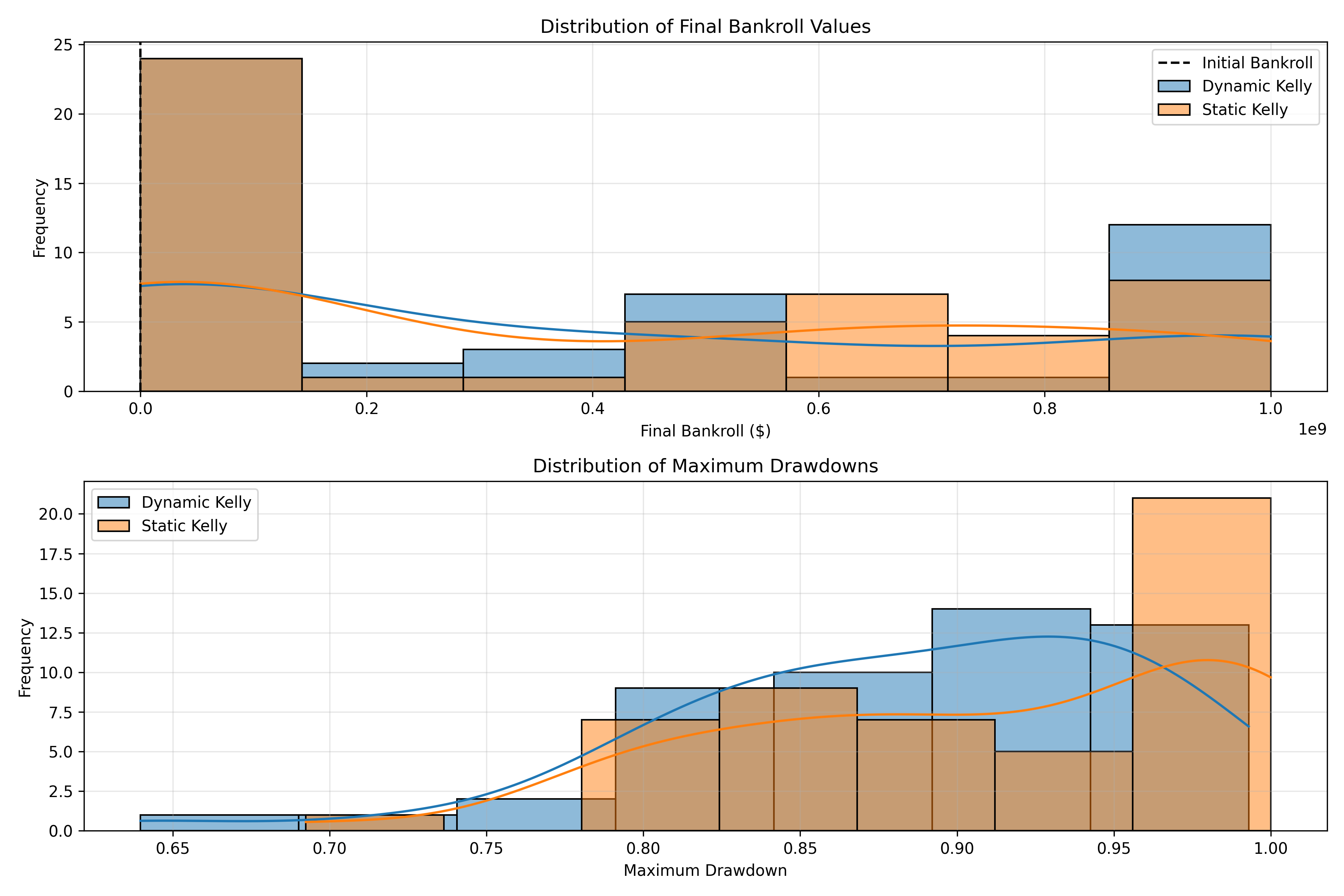

Comparing Dynamic Management with Static Strategies

Let’s see how Dynamic Bankroll Management compares to static strategies like Kelly and Fixed Fraction:

from keeks.bankroll import BankRoll

from keeks.binary_strategies.kelly import KellyCriterion

from keeks.binary_strategies.fixed_fraction import FixedFraction

from keeks.binary_strategies.dynamic import DynamicBankrollManagement

from keeks.simulators.repeated_binary import RepeatedBinarySimulator

import matplotlib.pyplot as plt

# Set up our simulation parameters

win_probability = 0.55

payoff = 1.0

loss = 1.0

trials = 1000

initial_funds = 1000.0

# Create strategies

kelly = KellyCriterion(payoff=payoff, loss=loss)

fixed_fraction = FixedFraction(fraction=0.03)

dynamic_moderate = DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.5, max_decrease=0.5, lookback_period=5

)

dynamic_aggressive = DynamicBankrollManagement(

base_fraction=0.03, max_increase=0.75, max_decrease=0.5, lookback_period=5

)

# Calculate the Kelly fraction for this scenario

kelly_fraction = kelly.calculate_bet_fraction(win_probability)

print(f"Kelly fraction for this scenario: {kelly_fraction:.4f}")

# Create a simulator with fixed random seed for fair comparison

simulator = RepeatedBinarySimulator(

payoff=payoff,

loss=loss,

probability=win_probability,

trials=trials,

random_seed=42 # Fixed seed ensures same sequence of wins/losses

)

# Run simulations

results = {}

strategies = {

"Kelly": kelly,

"Fixed Fraction (3%)": fixed_fraction,

"Dynamic Moderate": dynamic_moderate,

"Dynamic Aggressive": dynamic_aggressive

}

for name, strategy in strategies.items():

bankroll = BankRoll(initial_funds=initial_funds)

simulator.evaluate_strategy(strategy, bankroll)

results[name] = {

"history": bankroll.history.copy(),

"drawdowns": bankroll.drawdown_history.copy()

}

# Plot the bankroll histories

plt.figure(figsize=(12, 8))

for name, data in results.items():

plt.plot(data["history"], label=name)

plt.title('Dynamic vs Static Strategies')

plt.xlabel('Number of Bets')

plt.ylabel('Bankroll Size')

plt.legend()

plt.grid(True)

plt.show()

# Calculate and display statistics

for name, data in results.items():

history = data["history"]

drawdowns = data["drawdowns"]

final_value = history[-1]

max_drawdown = max(drawdowns) * 100

growth_rate = (final_value / initial_funds) ** (1 / trials) - 1

print(f"{name}:")

print(f" Final bankroll: ${final_value:.2f}")

print(f" Growth rate: {growth_rate:.2%} per bet")

print(f" Maximum drawdown: {max_drawdown:.2f}%")

print()

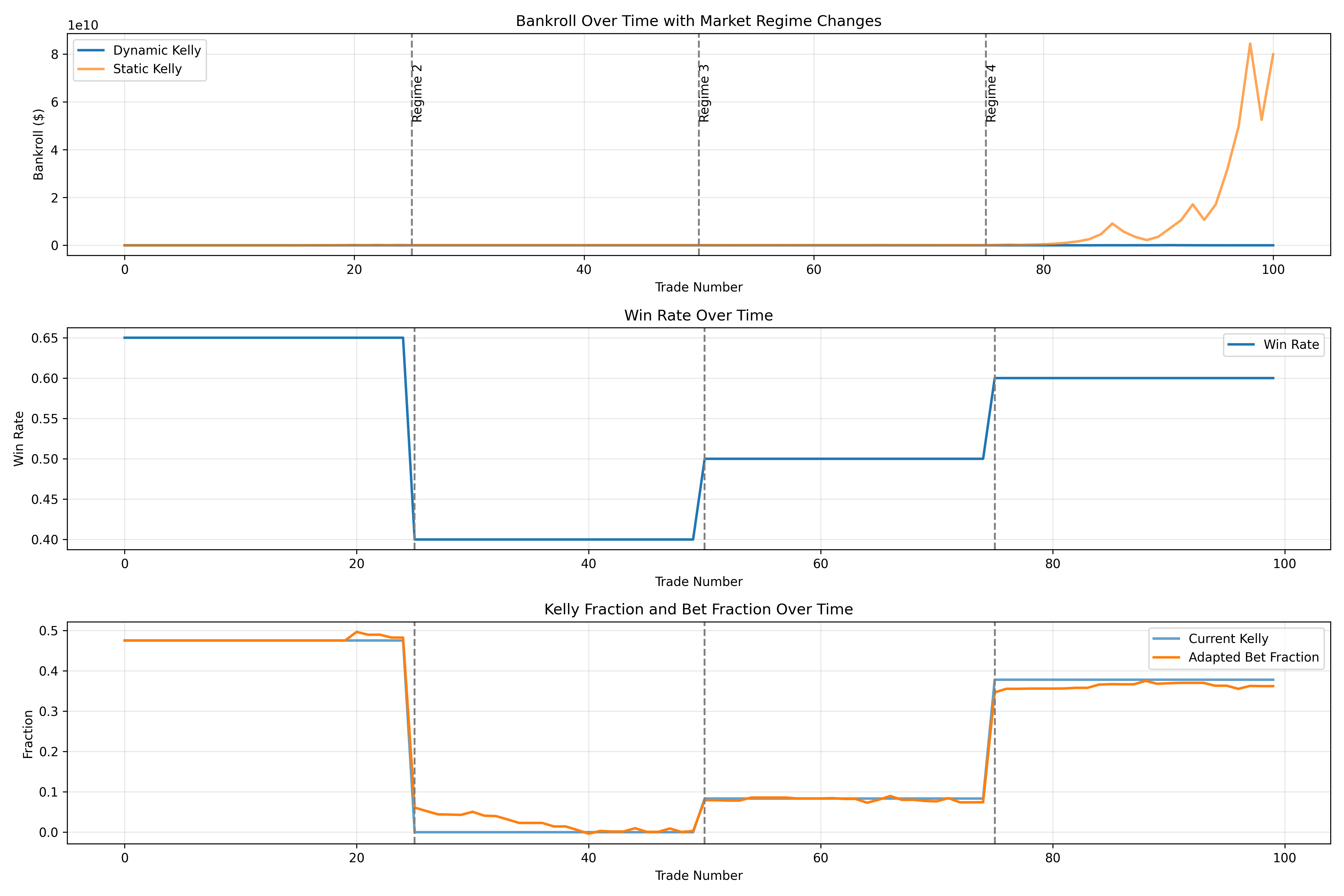

Real-World Example: Sports Betting with Streaks

Let’s consider a practical example of using Dynamic Bankroll Management for a sports bettor experiencing hot and cold streaks:

from keeks.bankroll import BankRoll

from keeks.binary_strategies.dynamic import DynamicBankrollManagement

import numpy as np

import matplotlib.pyplot as plt

# Create a bankroll with $5,000

bankroll = BankRoll(initial_funds=5000.0)

# Create a Dynamic Bankroll Management strategy

dbm = DynamicBankrollManagement(

base_fraction=0.02, # 2% base bet

max_increase=0.5, # Up to 50% increase (max 3% of bankroll)

max_decrease=0.75, # Up to 75% decrease (min 0.5% of bankroll)

lookback_period=5 # Consider last 5 bets

)

# Let's simulate a betting season with streaks

# We'll create a sequence of 100 bets with some hot and cold streaks

np.random.seed(42)

results = []

# Start with normal 55% win rate

for i in range(30):

results.append(1 if np.random.random() < 0.55 else -1)

# Cold streak (30% win rate for 20 bets)

for i in range(20):

results.append(1 if np.random.random() < 0.3 else -1)

# Hot streak (70% win rate for 20 bets)

for i in range(20):

results.append(1 if np.random.random() < 0.7 else -1)

# Back to normal 55% win rate

for i in range(30):

results.append(1 if np.random.random() < 0.55 else -1)

# Track our bankroll and bet sizes

bankroll_history = [bankroll.current_funds]

bet_sizes = []

bet_fractions = []

# Simulate the bets

for i, result in enumerate(results):

# Calculate the bet size

current_streak = results[max(0, i-dbm.lookback_period):i]

bet_fraction = dbm.calculate_bet_fraction(current_streak)

bet_size = bet_fraction * bankroll.current_funds

# Record the bet size

bet_sizes.append(bet_size)

bet_fractions.append(bet_fraction)

# Apply the result

if result == 1:

# Win

bankroll.update(bet_size)

else:

# Loss

bankroll.update(-bet_size)

# Record the new bankroll

bankroll_history.append(bankroll.current_funds)

# Plot the results

fig, (ax1, ax2, ax3) = plt.subplots(3, 1, figsize=(12, 12), sharex=True)

# Plot the bankroll

ax1.plot(bankroll_history)

ax1.set_title('Bankroll Over Time')

ax1.set_ylabel('Bankroll ($)')

ax1.grid(True)

# Plot the bet sizes

ax2.plot(bet_sizes)

ax2.set_title('Bet Sizes Over Time')

ax2.set_ylabel('Bet Size ($)')

ax2.grid(True)

# Plot the bet fractions

ax3.plot(bet_fractions)

ax3.axhline(y=0.02, color='r', linestyle='--', label='Base Fraction (2%)')

ax3.set_title('Bet Fractions Over Time')

ax3.set_xlabel('Bet Number')

ax3.set_ylabel('Bet Fraction')

ax3.legend()

ax3.grid(True)

# Add vertical lines to indicate the streak changes

for ax in [ax1, ax2, ax3]:

ax.axvline(x=30, color='g', linestyle='--', alpha=0.5, label='Start Cold Streak')

ax.axvline(x=50, color='r', linestyle='--', alpha=0.5, label='Start Hot Streak')

ax.axvline(x=70, color='b', linestyle='--', alpha=0.5, label='Return to Normal')

plt.tight_layout()

plt.show()

# Calculate final statistics

final_bankroll = bankroll_history[-1]

max_bankroll = max(bankroll_history)

min_bankroll = min(bankroll_history)

max_drawdown = (max_bankroll - min_bankroll) / max_bankroll * 100

total_return = (final_bankroll / 5000.0 - 1) * 100

print(f"Betting Statistics:")

print(f" Initial bankroll: $5,000.00")

print(f" Final bankroll: ${final_bankroll:.2f}")

print(f" Total return: {total_return:.2f}%")

print(f" Maximum bankroll: ${max_bankroll:.2f}")

print(f" Minimum bankroll: ${min_bankroll:.2f}")

print(f" Maximum drawdown: {max_drawdown:.2f}%")

print()

print(f"Bet Sizing Statistics:")

print(f" Average bet size: ${np.mean(bet_sizes):.2f}")

print(f" Maximum bet size: ${max(bet_sizes):.2f}")

print(f" Minimum bet size: ${min(bet_sizes):.2f}")

print(f" Average bet fraction: {np.mean(bet_fractions):.2%}")

When to Use Dynamic Bankroll Management

Dynamic Bankroll Management is particularly well-suited for:

- Streaky environments: Markets or sports with momentum or autocorrelation

- Varying edge scenarios: When your edge changes based on conditions

- Psychological alignment: When you want bet sizing to match your confidence

- Adaptive approach: When you prefer a system that responds to feedback

- Experienced bettors: Who can distinguish between variance and changing edge

Designing Your Dynamic Strategy

When implementing a Dynamic Bankroll Management strategy, consider these key parameters:

- Base strategy: Start with a solid foundation (Kelly, Fixed Fraction, etc.)

- Adjustment factors: How much to increase/decrease based on performance

- Lookback period: How many recent bets to consider when adjusting

- Limits: Maximum and minimum bet sizes to prevent extreme adjustments

- Triggers: What conditions trigger adjustments (wins/losses, volatility, etc.)

The optimal configuration depends on your betting style, the markets you’re in, and your risk tolerance.

Conclusion

Dynamic Bankroll Management represents a sophisticated approach to bet sizing that adapts to changing conditions. By adjusting your exposure based on recent performance and market conditions, it provides a flexible framework that can potentially outperform static strategies in certain environments.

While more complex to implement and tune than fixed strategies, DBM’s adaptability makes it particularly valuable in markets with streaks, changing edges, or varying volatility. For experienced bettors who can distinguish between normal variance and genuine shifts in their edge, DBM offers a powerful tool for optimizing bankroll growth while managing risk.

In our next post, we’ll explore the Naive Strategy, a simple approach that serves as a useful baseline for comparing more sophisticated bankroll management methods.

Stay in the loop

Get notified when I publish new posts. No spam, unsubscribe anytime.